Self-Funding

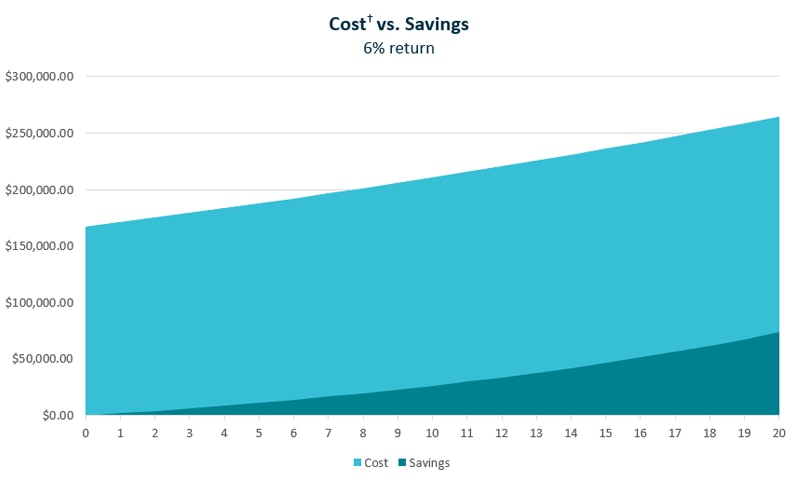

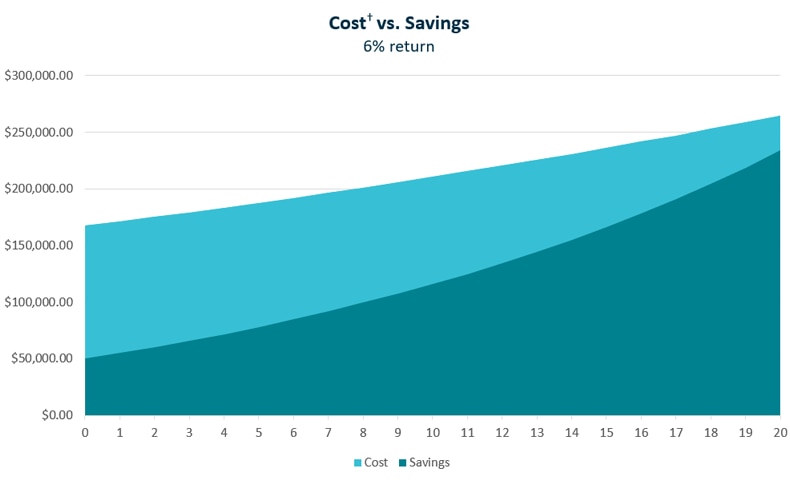

People pay for long term care in different ways. This can include using your or your family's personal resources, including savings and investments, or other assets such as your home.

When determining whether you should self-fund or purchase long term care insurance, it's important to look at your current and future savings and assets to determine how much you can afford to spend, specifically for long term care. What may work for a person with few resources, a modest income, and a goal of staying off Medicaid will be very different from someone with a larger amount of assets and income.

You should also consider the cost of long term care and how long you think you will need it.

Paying for long term care

Below are the costs in today's dollar. Is this something that you can afford to pay from your own savings if you need care now?

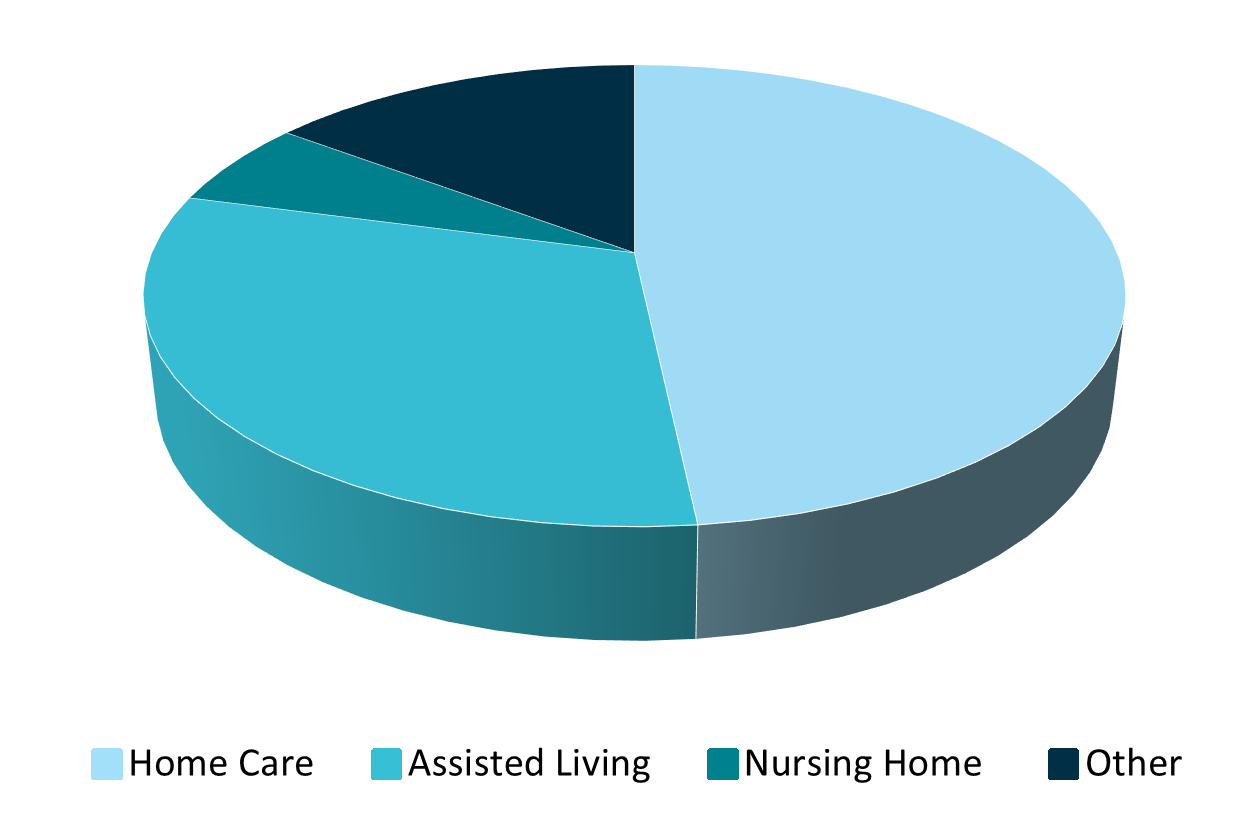

| National Average Annual Cost of Care1 | ||

|---|---|---|

| Home Care | $51,480* | |

| Assisted Living | $66,132 | |

| Nursing Home | $112,420 | |

| Average | $76,677 | |

Use our Cost of Care Tool to find the average cost of care in your area.